How to Upload a Fidelity File in Taxact

TaxAct Self-Employed Online is designed for small concern owners, freelancers, sole proprietors, and consultants. TaxAct Self-Employed Online guarantees the maximum tax benefit for its users and also offers audit protection.

While TaxAct Self-Employed tin be used by those doing their own tax return for the first time, the product is better suited to those that are familiar with the online tax-filing process. TaxAct Self-Employed includes stride-by-pace guidance throughout the process, with an pick to jump directly to the forms y'all need to admission. Find out if it's correct for you with our total TaxAct Self-Employed Online review.

TaxAct Self-Employed Online's features

TaxAct Cocky-Employed offers a long listing of features, including a maximum refund guarantee, too as a deduction maximizer to ensure that you're taking advantage of all bachelor deductions. TaxAct Self-Employed lets you enter all relevant freelance income along with any other business organization or farm income. You lot can besides calculate depreciation totals using the application.

If you make a lot of charitable contributions, you'll desire to use the Donation Banana, and you can also calculate and study any stock gains or losses using the stock assistant.

One of the most important things that small concern owners can do is programme for future taxes. TaxAct Self-Employed provides you with the tools to practice so, including a "what-if" option, where yous can plan out multiple scenarios to observe the most benign one for your business organization.

TaxAct Self-Employed also includes a mobile app for both iOS and Android devices.

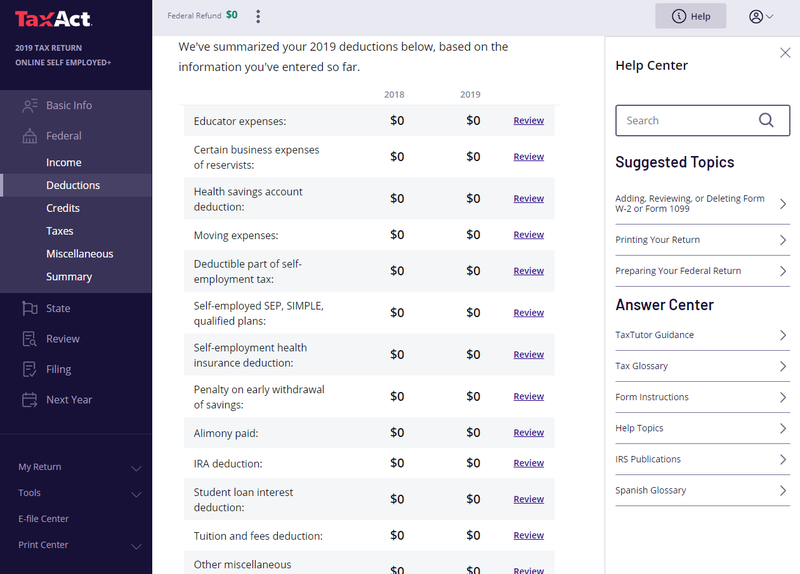

Deduction Maximizer

TaxAct Cocky-Employed's Deduction Maximizer offers a step-by-footstep process to uncover common deductions that are specific to your item field of business.

The Deductions screen displays a list that compares 2018 deductions to 2019 deductions.

For example, if y'all're a writer, you'll be able to view deductions related to your business such as business use of your dwelling, writing supplies and expenses, and concern-related travel.

For photographers, the deduction choices may include items such every bit photography equipment, advertizing expenses, and website hosting.

Deductions for other fields include computers and other related concern equipment, membership dues, software licenses, and studio or storefront rental costs.

Estimate taxes for future years

While we consummate our tax returns once a year, true tax planning takes place throughout the year, specially for business owners. TaxAct Self-Employed allows you to calculate tax liability for hereafter years by estimating your future earnings and expenses using various "what-if" scenarios.

While this is only an estimate, using this feature can help yous be better prepared for hereafter taxation liability, and plan your business around it accordingly.

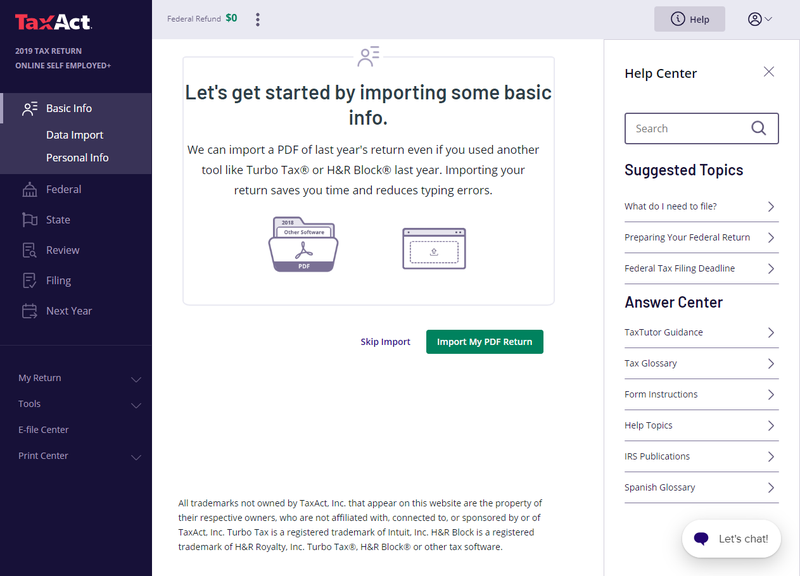

Data import

TaxAct Self-Employed will permit you to import last yr's tax return from other tax preparation applications such equally TurboTax and H&R Cake.

The import option is displayed in TaxAct Self-Employed immediately upon sign-in.

Importing this data tin save you a lot of time, while besides helping to reduce the amount of data entry you demand to complete in order to procedure your return.

In addition to importing your tax return, you lot can likewise import charitable contribution receipts and W-2s. Information technology'due south important to notation that importing your taxation documents may non be an option, since the import procedure is dependent on the payroll service that produced the document.

At that place is no option to snap a photo of whatsoever certificate to import into TaxAct Self-Employed at this fourth dimension.

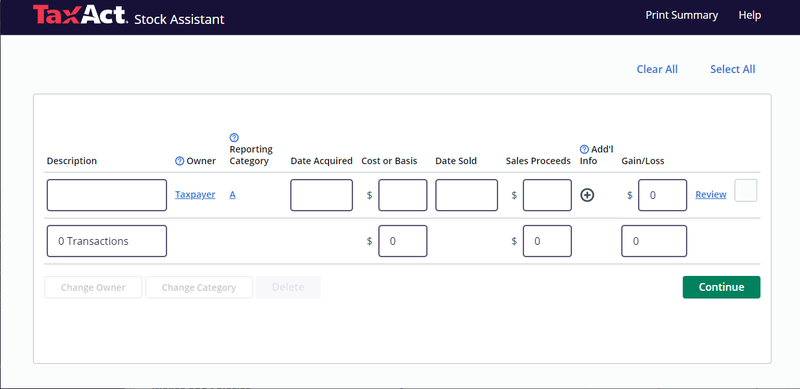

Tools

The Tools feature in TaxAct Self-Employed offers a variety of Administration, which tin can be incredibly useful, depending on your circumstances. The post-obit Assistants are bachelor:

- Donation Assistant: The Donation Banana allows you to create a donation event, which is used if you have donated multiple items to the aforementioned clemency. Once y'all create the event, you can add details for all donated items.

- Stock Assistant: The Stock Banana helps you easily calculate your gains or losses on any stock transactions.

- Forms Assistant: The Forms Banana provides yous with a list of all available tax forms, with links that will have you directly to any forms you wish to access.

- Topics Assistant: The Topics Assistant lets you search for any tax topic. Simply choose the topic you're interested in and click the View Topic push.

The Stock Banana helps you effigy gains and losses on stock transactions.

TaxAct Self-Employed besides includes a variety of calculators including a Taxation Calculator, Loan Calculator, and Savings Calculator.

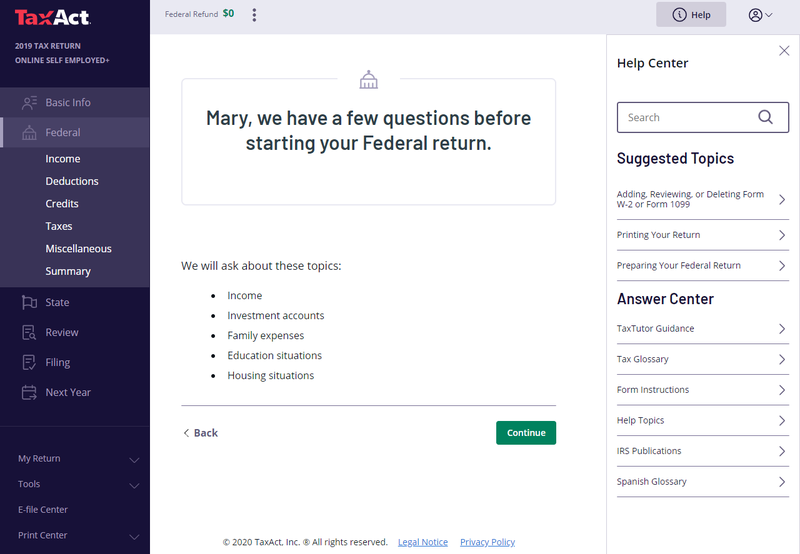

TaxAct Self-Employed Online's ease of utilize

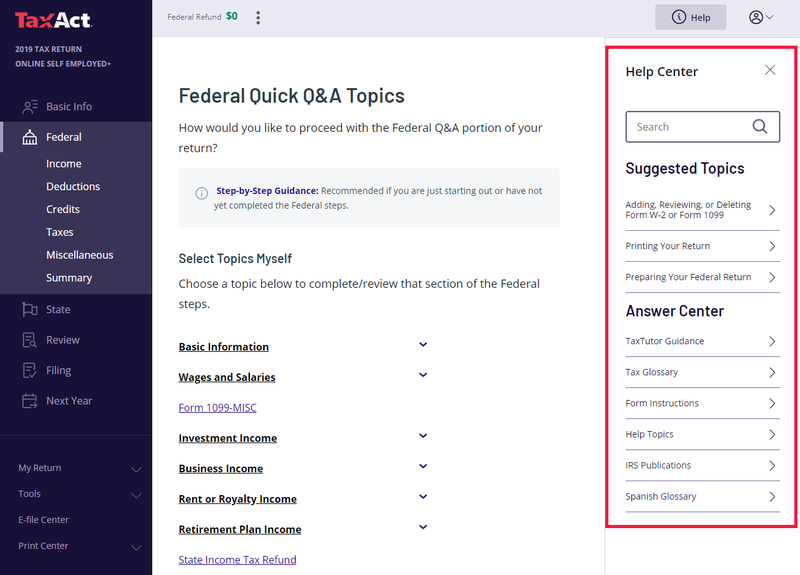

TaxAct Self-Employed Online offers easy navigation with step-by-footstep guidance available for new users. A navigation bar to the left of the screen allows you to spring to the appropriate section when desired, and a assistance option to the right of the screen allows you to search the Assistance Centre or scan suggested topics.

TaxAct Cocky-Employed guides you through the procedure of adding your income and expenses.

TaxAct Self-Employed screens can experience somewhat crowded at times, every bit they tend to utilize a lot of text on each screen.

While it is nice to combine several questions on one page, rather than having to continually whorl through multiple pages, the amount of text that needs to be read on each page can exist overwhelming at times.

TaxAct Self-Employed Online'southward pricing

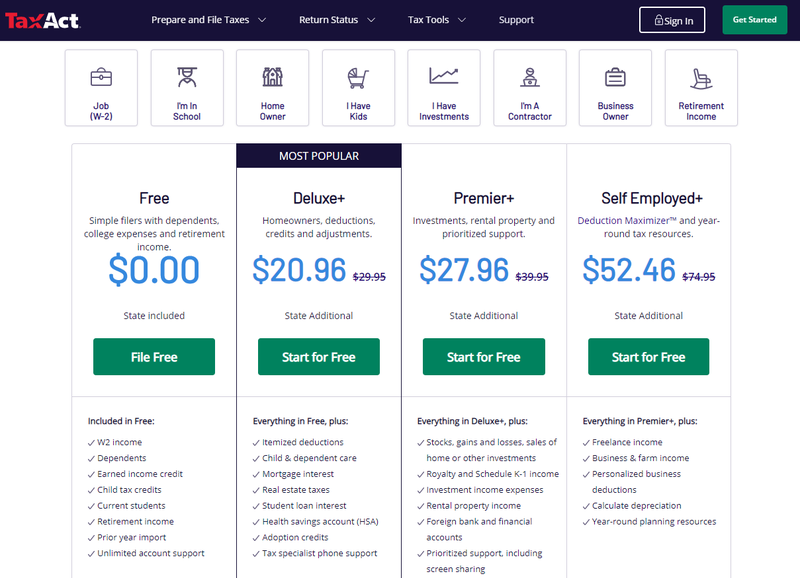

TaxAct Self-Employed fees are reasonable, with four plans available, including the Cocky Employed programme that is designed for freelancers, modest businesses, and consultants.

TaxAct Self-Employed offers iv plans, including the Cocky-Employed for small business owners.

The Free plan is suitable for those with simple returns, while the Deluxe plan, which runs $twenty.96, and the Premier program, which is $27.96, include other features such as itemized deductions, stock sales and purchases, and rental property income.

The Self-Employed version, the almost expensive at $52.48, offers complete freelance income management, forth with personalized business deductions and yr-round small business organization tax planning resources.

Keep in mind that TaxAct Self-Employed prices can change oftentimes, then be sure to check out their website for the latest pricing.

TaxAct Cocky-Employed Online's support

TaxAct Cocky-Employed includes excellent support options, with the Deluxe, Premier, and Self-Employed plans all offering both telephone and electronic mail back up.

All plans have access to the Reply Center, and a search role is available in the application.

The Help Center, to the correct of the entry screens, offers like shooting fish in a barrel access to the Reply Eye.

All plan users tin can also admission the TaxAct Self-Employed Support folio, where y'all tin hands view the most pop topics, besides as access topics in a diverseness of categories, including Getting Started, Electronic Filing and Printing, Download options, and News and Reference.

TaxAct Self-Employed as well includes prioritized revenue enhancement support, with a dedicated telephone line bachelor. Back up is provided by experienced tax specialists, though they don't specify whether they are an enrolled agent (EA) or CPA.

The application also includes screen share capability and an in-app chat option.

Benefits of TaxAct Self-Employed Online

The benefits of using TaxAct Cocky-Employed are numerous, starting with the power to save some coin upfront, since TaxAct Self-Employed costs less than many of its competitors. Another benefit is the ability to import your tax documents, including W-2s, though not all forms are eligible to be imported.

TaxAct Self-Employed offers good assistance options for paid plan users, including a screen sharing feature that allows back up personnel to view your current screen.

Finally, you tin can access the various Administration in TaxAct Self-Employed to easily summate donation totals, stock gains and losses, also as access a diverseness of forms. One drawback to TaxAct Self-Employed is that state filing is higher than the competition at $39.95.

Is TaxAct Self-Employed right for you lot?

If yous're a pocket-size business organization owner, freelancer, or sole proprietor and you're looking for a great taxation software, you owe information technology to yourself to check out TaxAct Cocky-Employed.

Like its competitors, TaxAct Self-Employed offers easy navigation, an interview procedure helpful to new filers, and proficient support options for all of its paid plans, all with a price lower than much of the competition.

Source: https://www.fool.com/the-ascent/taxes/taxact-self-employed-online-review/

0 Response to "How to Upload a Fidelity File in Taxact"

Post a Comment